Irs withholding calculator 2020

Citizen or Resident Alien for all of. Line 4a to increase the amount of income subject to withholding.

Tax Withholding Estimator New Free 2019 2020 Irs Youtube

Employees Withholding Certificate Form 941.

. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Online competitor data is extrapolated from press releases and SEC filings. Calculating a level of tax withholding thats just right can sometimes take as much time as preparing your tax return.

The following income chapter 3 status and Limitation on benefits LOB codes were added to Form 1042-S. Changes to Form 1042-S. No special form is needed.

To change the amount of tax withholding or to stop withholding call OPMs Retirement Information Office at 1-888-767-6738. But if you prefer to have more tax than necessary withheld from each paycheck you will get that money back as a refund when you file your tax return keep in mind though you do not earn interest on the amount you overpay. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

You will need your retirement CSA or CSF claim number and your social security number when you call. How to Estimate Your 2019 Tax Liability An Example. Beginning with tax year 2020 nonresident alien taxpayers will file a redesigned Form 1040-NR which is similar to the Form 1040.

You dont need to do anything at this time. It aligns with changes made by the 2017 Tax Cuts and Jobs Act TCJA. Nonresident alien taxpayers should use Form 1040-NR.

Use this worksheet to figure your capital loss carryovers from 2020 to 2021 if your 2020 Schedule D line 21 is a loss and a. Income tax withholding on your tax return you should carefully review all information documents such as Form W-2 and the Form 1099 information returns. 2021 2022 Paycheck and W-4 Check Calculator.

Was extended per the COVID-related Tax Relief Act of 2020. Previously filed Oregon or federal withholding statements Form OR-W-4 or Form W-4 which are used for Oregon withholding can remain in place. And line 4b to decrease the amount of income subject to withholding.

Employers Quarterly Federal Tax Return. To keep your same tax withholding amount. Use TurboTaxs W-4 Withholding Calculator to determine the amount of withholding you should state on you and your spouses W-4s.

If you have TTYTDD equipment call 1-855-887-4957. The Tax Withholding Estimator IRSgovW4app makes it easier for everyone to pay the correct amount of tax during the year. These four possibilities.

The Tax Withholding Estimator compares that estimate to your current tax withholding and can help you decide if you need to change your withholding with your employer. The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4 calculator tool for you. The American Rescue Plan Act of 2021 the ARP adds new sections 3131 3132 and 3133 to the Internal Revenue Code to provide credits for qualified sick and family leave wages similar to the credits.

Self-Employed defined as a return with a Schedule CC-EZ tax form. Publication 3 - Introductory Material Whats New Reminders Introduction. HR Block does not provide audit attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns.

However this transitional tool will no longer be available after 2022. If the return is not complete by 531 a 99 fee for federal and 45 per state return will be applied. Beginning with tax year 2020 Form 1040-NR-EZ is no longer available.

Offer valid for returns filed 512020 - 5312020. Tax Withholding Estimator FAQs. The IRS also provides a federal tax calculator for withholding each year.

WASHINGTON Following the biggest set of tax law changes in more than 30 years the Internal Revenue Service continues to remind taxpayers to do a Paycheck Checkup to help make sure they are having the right amount of tax withheld. Estimate your paycheck withholding with our free W-4 Withholding Calculator. Now you can easily create a Form W-4 that reflects your planned tax withholding amount.

But the IRS introduced a new Form W-4 beginning with the tax year 2020 that can simplify the process a bit. IRS Individual taxpayer identification number ITIN. Were you a US.

New income code 56 was added to address section 871m transactions resulting from combining transactions under Regulations section 1871-15n including as modified by transition relief under Notice 2020-2. So beginning in 2020 Form W-4 offers employees four ways to change their withholding. 51 Agricultural Employers Tax Guide.

Since early 2020 any change made to state withholding must be made on Form OR-W-4 as the new federal Form W-4 cant be used for Oregon withholding purposes. Line 3 to reduce the amount of tax withheld. 15-T Federal Income Tax Withholding Methods available at IRSgovPub15TYou may also use the Income Tax Withholding Assistant for Employers at IRSgovITWA to help you figure federal income tax withholding.

The TCJA eliminated the personal exemption. IR-2019-110 June 12 2019. Complete the new Form W-4 as soon as possible.

File Form 1040 or 1040-SR by April 18 2022. Ask your employer if they use an automated system to submit Form W-4. If the distribution was for a 2020 excess deferral your Form 1099-R should have code P in box 7.

The longer you wait the fewer pay periods youll have to take advantage of your new withholding amount. This publication supplements Pub. More details about the Tax Withholding Estimator and the new 2020 withholding tables can be found on the Frequently Asked Question pages.

The Tax Cuts and Jobs Act TCJA tax reform legislation enacted in December 2017 changed the way. Self-Employed defined as a return with a. The Withholding Form.

It describes how to figure withholding using the Wage Bracket Method or Percentage Method describes the alternative methods for figuring withholding and provides the Tables for Withholding on Distributions of Indian Gaming Profits to Tribal Members. Before you report US. The due date is April 18 instead of April 15 because of the Emancipation Day holiday in the District of Columbiaeven if you dont live in.

This will reduce your withholding and increase your take-home pay. 15 Employers Tax Guide and Pub. Submit or give Form W-4 to your employer.

The federal income tax withholding tables are included in Pub. The redesigned Form W-4 makes it easier for you to have your withholding match your tax liability. Employers Quarterly Federal Tax Return.

If you didnt receive the distribution by April 15 2021 you must also add it to your wages on your 2021 tax return. Individuals can use this tax calculator to determine their tax liabilities. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate.

If you didnt add the excess deferral amount to your wages on your 2020 tax return you must file an amended return on Form 1040-X. To change your tax withholding amount. Attach Form 1040-NR Schedules OI A and NEC to Form 1040-NR as.

Line 4c to increase the amount of tax withheld. The tool is a convenient online way to check and tailor your withholding. You and your spouse earned a combined 80000 in 2018.

Compare other records such as final pay records or bank statements with Form W-2 or Form 1099 to verify the withholding on these forms. If youre using the IRS withholding tables for forms from 2020 and later there is a Standard withholding and a Form W-4 Step 2 Checkbox withholding amount in place of the. Due date of return.

Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand how to maximize your tax refund or take-home pay. Have there been changes to withholding.

Test Your Knowledge Of The Irs Tax Withholding Estimator Bds Financial Network

How To Calculate Federal Income Tax

Irs Releases New Form W 4 And Online Withholding Calculator Personal Wealth Strategies

Mobile Farmware Irs Form W 4 2020

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs 2020 Tax Tables Deductions Exemptions Purposeful Finance

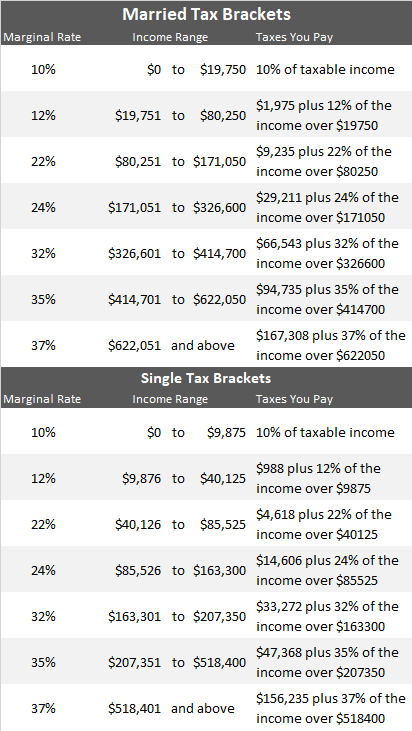

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Irs Releases An Early Draft Of The 2020 W 4 Erp Software Blog

A New Form W 4 For 2020 Alloy Silverstein

Back Office Tax Tools Tax Set Up 2020 Tax Set Up Tabs Support Center

How To Calculate Payroll Taxes For Employees Startuplift

Tax Calculator Estimate Your Income Tax For 2022 Free

Tax Withholding For Pensions And Social Security Sensible Money

How To Get Irs Tax Transcript Online For I 485 Filing Usa

Do I Need To File A Tax Return Forbes Advisor

Irs Improves Online Tax Withholding Calculator

Irs Amends Form W 4 For 2020 Employee Withholding Onyx Tax Tax Relief Irs Representation Charleston Sc